Tax jurisdictions who have committed to the Automatic Exchange of Information (AEOI) global standard must utilise a technical solution to ensure a timely and effective implementation of the standard.

Giant has web solutions which will satisfy the reporting requirements of the Foreign Account Tax Compliance Act (FATCA), the Common Reporting Standard (CRS), Country by Country Reporting (CbCR), Nominal tax Jurisdiction (NTJ) and Mandatory Disclosure Rules (MDR). Exchange of Tax Rulings (ETR) and Exchange Of Information on Request (EOIR) can also be implemented.

Giant’s web based solutions have already been successfully implemented and are now available to other tax authorities. Our simple but effective approach means that a full implementation can be achieved in days rather than weeks. Our solution can easily be adapted to incorporate your tax authority’s organisational branding, as well as any bespoke functionality if required.

The quality of submissions is assured by comprehensive validation routines. These reduce the time and overhead of having to re-transmit a submission. Incoming returns are digitally signed and encrypted to ensure a secure transmission. Received submissions are also securely stored in an encrypted database. The system is successfully in use, and available to other tax jurisdictions now.

|

|

|

|

Rapid Implementation |

|

Established Solution |

|

100% Compliant |

|

Comprehensive Validation |

|

Available for FATCA, CRS, CbCR, NTJ or MDR |

|

Secure Submissions |

|

Apply Penalties |

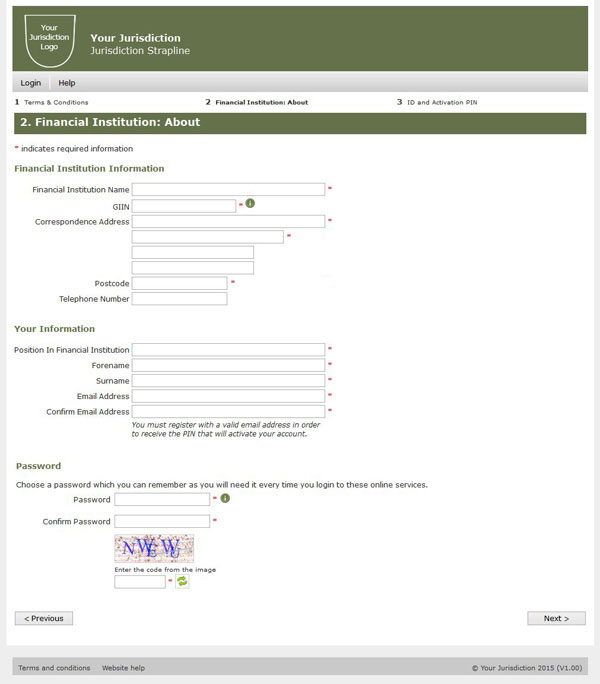

Financial Institutions must first register in order to provide submissions. Details including their GIIN (Global Intermediary Identification Number) for FATCA, or TIN (Tax Identification Number) for CRS or CbCR reporting, to be used for validation must be supplied. Registrations must then be approved prior to any submissions.

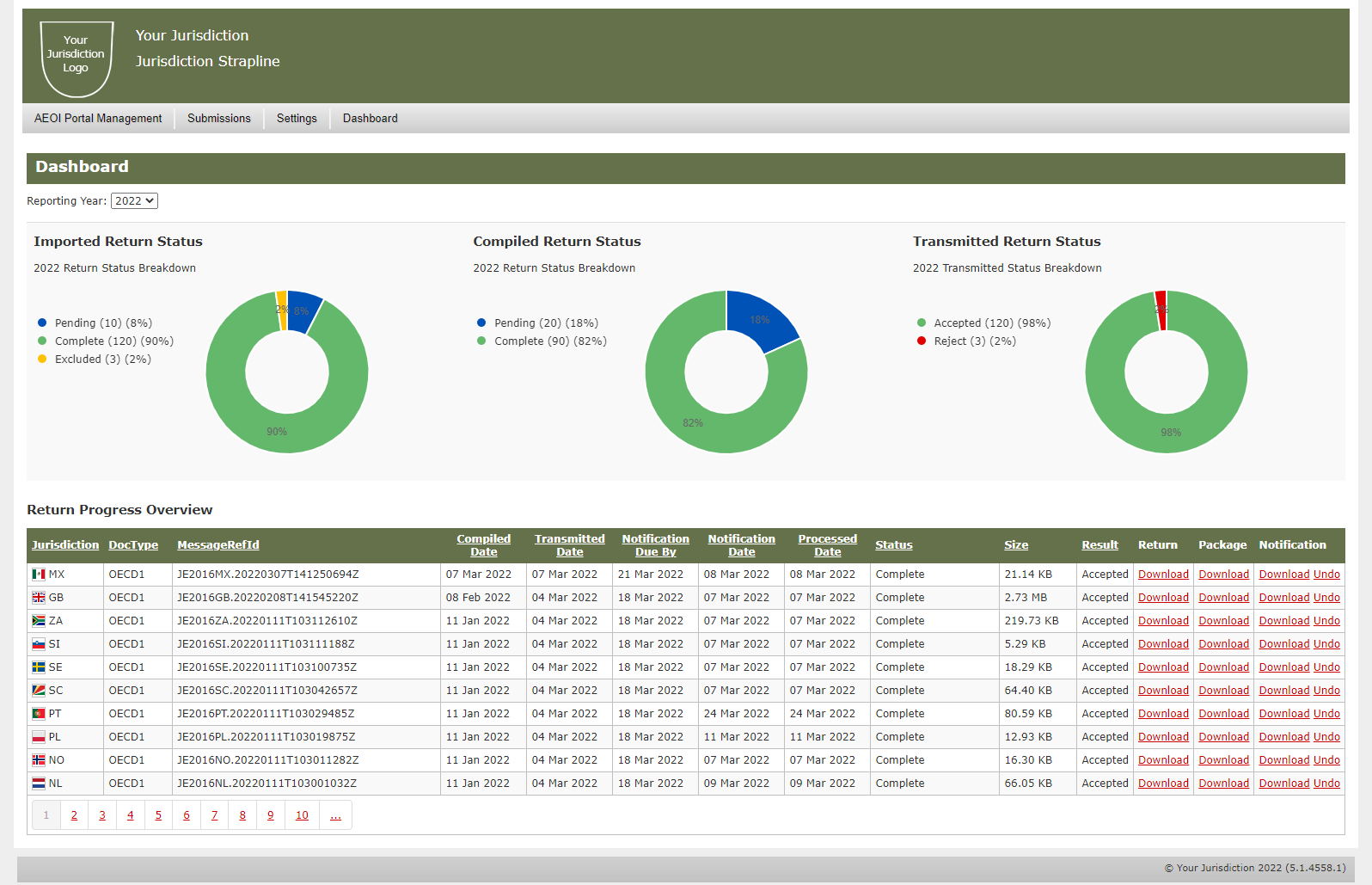

Financial Institutions upload their completed submissions in XML format. These are then validated against the latest OECD (CRS, CbCR) or IDES (FATCA) schemas. Any additional custom validation can then be applied. Financial Institutions receive a status email for their submission.

Each return is separated by tax jurisdiction for onward submission to the relevant authority. The administrator has visibility of each submission status and total control over onward submission.

The Reporting Entities register for the type of Agreement.

The registration is approved by an administrator.

On successful registration the Reporting Entity account is activated.

Submissions are security transmitted, validated and stored.

Submissions are forwarded to the relevant authority.

Registration

Approval

Activation

Submission

Send To

Jurisdiction

Initial free consultation.

Your organisational branding is applied.

Installation of the solution.

Thorough testing is conducted before going live.

The simplicity of the solution makes delivery so much quicker - days rather than weeks.

Consultation

Branding

Installation

Testing

Go Live